tksbrokerapi.TKSBrokerAPI

Technologies · Knowledge · Science

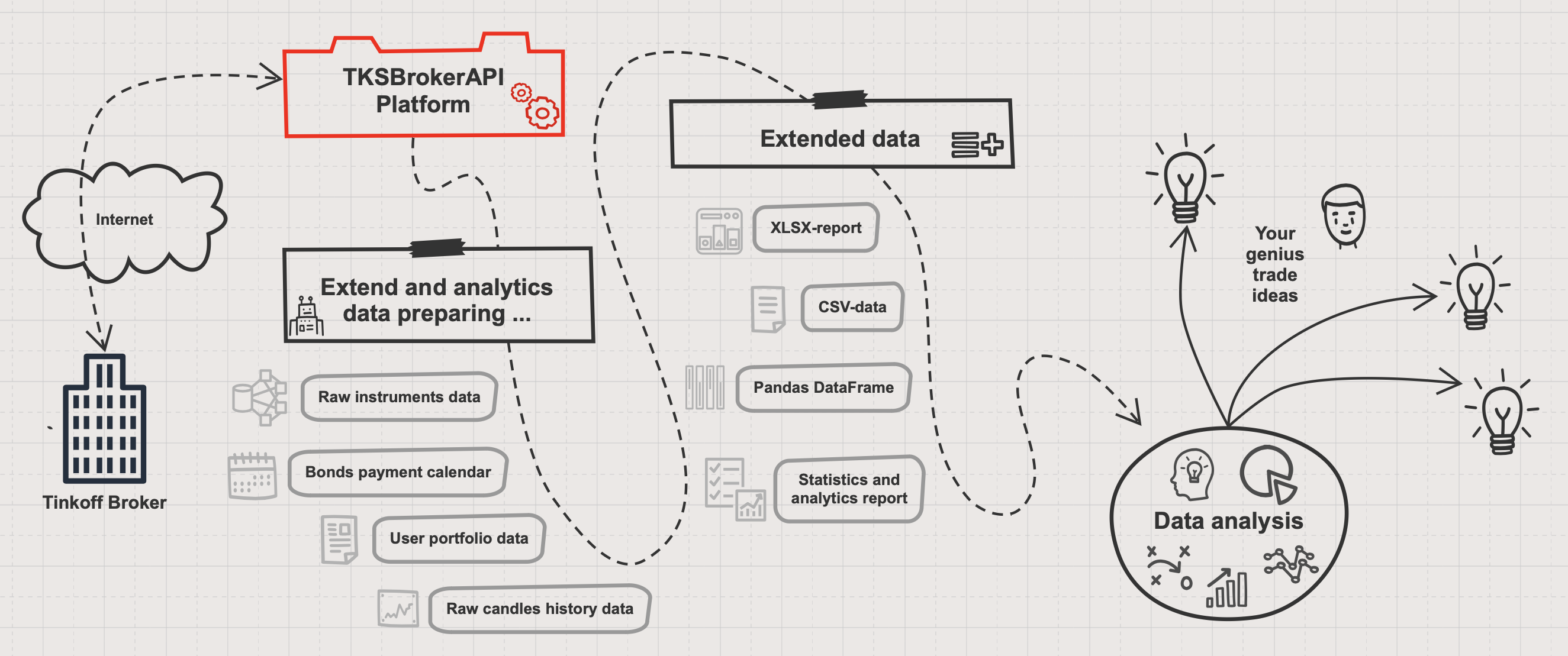

TKSBrokerAPI is the trading platform for automation and simplifying the implementation of trading scenarios,

as well as working with Tinkoff Invest API server via the REST protocol. The TKSBrokerAPI Platform may be used in two ways:

from the console, it has a rich keys and commands, or you can use it as Python module with python import.

TKSBrokerAPI allows you to automate routine trading operations and implement your trading scenarios, or just receive the necessary information from the broker. It is easy enough to integrate into various CI/CD automation systems.

See also:

- Open account for trading: https://tinkoff.ru/sl/AaX1Et1omnH

- TKSBrokerAPI Platform documentation: https://tim55667757.github.io/TKSBrokerAPI/docs/tksbrokerapi/TKSBrokerAPI.html

- CLI examples: https://github.com/Tim55667757/TKSBrokerAPI/blob/master/README_EN.md#Usage-examples

- Used constants are in the TKSEnums module: https://tim55667757.github.io/TKSBrokerAPI/docs/tksbrokerapi/TKSEnums.html

- About Tinkoff Invest API: https://tinkoff.github.io/investAPI/

- Tinkoff Invest API documentation: https://tinkoff.github.io/investAPI/swagger-ui/

- How to implement trading scenario in Python: https://github.com/Tim55667757/TKSBrokerAPI/blob/master/README_EN.md#Module-import

Using the TKSBrokerAPI Platform,

you can implement any trading scenario in Python. Many system used for making trading decisions about buying or selling

(technical analysis, neural networks, parsing reports or tracking other traders’ transactions), but you still need

to perform trading operations: place orders, open and close transactions. The TKSBrokerAPI module will act as an

intermediary between the code with the trading logic and services infrastructure of the Tinkoff Investments broker,

as well as perform routine tasks on your behalf in brokerage account.

The scheme of trade scenario automation with TKSBrokerAPI is very simple:

- You come up with a brilliant trading algorithm.

- Write it down step by step in the form of some kind of plan or trading scenario.

- Automate scenario as a Python script using TKSBrokerAPI.

- TKSBrokerAPI takes care of all the work with the Tinkoff Investments broker infrastructure.

- Profit!

But where to get this "brilliant trading algorithm"? The TKSBrokerAPI Platform will also help you solve the problem of obtaining primary, "raw" data on trading instruments (shares, bonds, funds, futures and currencies) from the broker server, for their future analysis in any analytical tool convenient for you. To do this, the methods of the TKSBrokerAPI module provide the ability to extend and save data in classic formats: XLSX and CSV (for analysis in spreadsheet editors), Markdown (for readability), and Pandas DataFrame (for data scientists and stock analysts).

The "raw" data can be anything that can be obtained from the broker's server. After extends, this data can be used to build, for example, a consolidated payment calendar for bonds and calculate their coupon and current yields, or you can generate analytics about the status of the user's portfolio and the distribution of assets by types, companies, industries, currencies, and countries. In addition, you can download historical data on the prices of any instrument as OHLCV-candlesticks.

How data is extended and used in TKSBrokerAPI Platform:

- You request the data you need from the Tinkoff Investments broker server:

- in this module, almost all methods return "raw" data from the server in the form of a Python dictionary.

- Then they are processed and extended:

- with various statistics, parameters and some analytical reports.

- After that, the data is stored in a form suitable for further analysis:

- most of the methods return extended data in the form of a Python dictionary or Pandas DataFrame;

- if you launched the TKSBrokerAPI platform in the console, then the data will be saved in XLSX, CSV or Markdown formats.

- Next, you can load the data into analytical system and use various data analysis methods to find and highlight dependencies, correlations, make predictions and suggest hypothesis.

- Further, based on data analysis, you come up with the same "brilliant trading algorithm".

- Automate the trading scenario (according to the previous scheme).

- Profit!

Initialize RateLimiter with given method limits (requests per minute).

Parameters

- methodLimits: dict[str, int] with per-method RPM limits.

This class implements methods to work with Tinkoff broker server.

Examples to work with API: https://tinkoff.github.io/investAPI/swagger-ui/

About token: https://tinkoff.github.io/investAPI/token/

Main class init.

Parameters

- token: Bearer token for Tinkoff Invest API. It can be set from environment variable

TKS_API_TOKEN. - accountId: string with numeric user account ID in Tinkoff Broker. It can be found in broker's reports.

Also, this variable can be set from environment variable

TKS_ACCOUNT_ID. - useCache: use default cache file with raw data to use instead of

iList.Trueby default. Cache is auto-update if new day has come. If you don't want to use cache and always updates raw data then setuseCache=False. - defaultCache: path to default cache file.

dump.jsonby default. - moreDebug: if

True, enables detailed debug-level logging for API requests, data processing, history segmentation, and other internal stages. Useful for development and diagnostics.Falseby default.

Enables more debug information in this class, such as net request and response headers in all methods. False by default.

RateLimiter object to work with given method limits (requests per minute) from TKS_METHOD_LIMITS.

Current TKSBrokerAPI Platform version: major.minor, but the build number define at the build-server only.

Latest version: https://pypi.org/project/tksbrokerapi/

Depth of Market (DOM) can be >= 1. Default: 1. It used with --price key to showing DOM with current prices for givens ticker or FIGI.

See also: GetCurrentPrices().

Tinkoff REST API server for real trade operations. Default: https://invest-public-api.tinkoff.ru/rest

See also: API method https://tinkoff.github.io/investAPI/#tinkoff-invest-api_1 and SendAPIRequest().

How many times retry after first request if a 5xx server errors occurred. If set to 0, then only first main request will be sent without retries. This allows you to reduce the number of calls to the server API for all methods.

3 times of retries by default.

See also: SendAPIRequest().

Sleep time in seconds between retries, in all network requests 3 seconds by default.

See also: SendAPIRequest().

Headers which send in every request to broker server. Please, do not change it!

Default: {"Content-Type": "application/json", "accept": "application/json", "Authorization": "Bearer {your_token}", "x-app-name": "Tim55667757.TKSBrokerAPI"}.

See also: SendAPIRequest().

If True then TKSBrokerAPI generate also HTML reports from Markdown. False by default.

See also: Mako Templates for Python (https://www.makotemplates.org/). Mako is a template library provides simple syntax and maximum performance.

Full path to the output file where history candles will be saved or updated. Default: None, it mean that returns only Pandas DataFrame.

See also: History().

Full path to the html file where rendered candles chart stored. Default: index.html.

See also: ShowHistoryChart().

Filename where full available to user instruments list will be saved. Default: instruments.md.

See also: ShowInstrumentsInfo().

Filename with all found instruments searched by part of its ticker, FIGI or name. Default: search-results.md.

See also: SearchInstruments().

Filename where prices of selected instruments will be saved. Default: prices.md.

See also: GetListOfPrices().

Filename where prices of selected instruments will be saved. Default: prices.md.

See also: ShowInstrumentsInfo(), RequestBondCoupons() and RequestTradingStatus().

Filename where wider Pandas DataFrame with more information about bonds: main info, current prices,

bonds payment calendar, some statistics will be stored. Default: ext-bonds.xlsx.

See also: ExtendBondsData().

Filename where bonds payment calendar will be saved. Default: calendar.md.

Pandas dataframe with only bonds payment calendar also will be stored to default file calendar.xlsx.

See also: CreateBondsCalendar(), ShowBondsCalendar(), ShowInstrumentInfo(), RequestBondCoupons() and ExtendBondsData().

Filename where current portfolio, open trades and orders will be saved. Default: overview.md.

See also: Overview(), RequestPortfolio(), RequestPositions(), RequestPendingOrders() and RequestStopOrders().

Filename where short digest of the portfolio status will be saved. Default: overview-digest.md.

See also: Overview() with parameter details="digest".

Filename where only open positions, without everything else will be saved. Default: overview-positions.md.

See also: Overview() with parameter details="positions".

Filename where open limits and stop orders will be saved. Default: overview-orders.md.

See also: Overview() with parameter details="orders".

Filename where only the analytics section and the distribution of the portfolio by various categories will be saved. Default: overview-analytics.md.

See also: Overview() with parameter details="analytics".

Filename where only the bonds calendar section will be saved. Default: overview-calendar.md.

See also: Overview() with parameter details="calendar".

Filename where history of deals and trade statistics will be saved. Default: deals.md.

See also: Deals().

Filename where table of funds available for withdrawal will be saved. Default: limits.md.

See also: OverviewLimits() and RequestLimits().

Filename where all available user's data (accountIds, common user information, margin status and tariff connections limit) will be saved. Default: user-info.md.

See also: OverviewUserInfo(), RequestAccounts(), RequestUserInfo(), RequestMarginStatus() and RequestTariffLimits().

Filename where simple table with all available user accounts (accountIds) will be saved. Default: accounts.md.

See also: OverviewAccounts(), RequestAccounts().

Filename where raw data about shares, currencies, bonds, etfs and futures will be stored. Default: dump.json.

Pandas dataframe with raw instruments data also will be stored to default file dump.xlsx.

See also: DumpInstruments() and DumpInstrumentsAsXLSX().

Dictionary with raw data about shares, currencies, bonds, etfs and futures from broker server. Auto-updating and saving dump to the iListDumpFile.

See also: Listing(), DumpInstruments().

PriceGenerator object to work with candles data: load, render interact and non-interact charts and so on.

See also: LoadHistory(), ShowHistoryChart() and the PriceGenerator project: https://github.com/Tim55667757/PriceGenerator

Identification TKSBrokerAPI tag in log messages to simplify debugging when platform instances runs in parallel mode. Default: "" (empty string).

String with ticker, e.g. GOOGL. Tickers may be upper case only.

Use alias for USD000UTSTOM simple as USD, EUR_RUB__TOM as EUR etc.

More tickers aliases here: TKSEnums.TKS_TICKER_ALIASES.

See also: SearchByTicker(), SearchInstruments().

String with FIGI identifier. FIGIs are case-sensitive and must be used as provided.

Example: ticker GOOGL has FIGI BBG009S39JX6.

See also: SearchByFIGI(), SearchInstruments().

Send GET or POST request to broker server and receive JSON object.

self.header: must be defining with dictionary of headers. self.body: if define then used as request body. None by default. self.timeout: global request timeout, 15 seconds by default.

Parameters

- url: url with REST request.

- reqType: send "GET" or "POST" request. "GET" by default.

- methodName: optional manual override for REST method name (used for throttling).

- _internalBody: DO NOT use this variable in your scripts! This is debug variable for internal used only.

Returns

response JSON (dictionary) from broker.

Gets JSON with raw data about shares, currencies, bonds, ETFs, and futures from broker server.

Returns

Dictionary with all available broker instruments: currencies, shares, bonds, ETFs, and futures.

Creates XLSX-formatted dump file with raw data of instruments to further used by data scientists or stock analytics.

See also: DumpInstruments(), Listing().

Parameters

Receives and returns actual raw data about shares, currencies, bonds, etfs and futures from broker server

using Listing() method. If iListDumpFile string is not empty then also save information to this file.

See also: DumpInstrumentsAsXLSX(), Listing().

Parameters

- forceUpdate: if

Truethen at first updates data withListing()method, otherwise just saves existiListas JSON-file (default:dump.json).

Returns

serialized JSON formatted

strwith full data of instruments, also saved to the--outputJSON-file.

Show information about one instrument defined by json data and prints it in Markdown format.

See also: SearchByTicker(), SearchByFIGI(), RequestBondCoupons(), ExtendBondsData(), ShowBondsCalendar() and RequestTradingStatus().

Parameters

- iJSON: json data of instrument, example:

iJSON = self.iList["Shares"][self._ticker] - show: if

Truethen also printing information about instrument and its current price. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

multilines text in Markdown format with information about one instrument.

Search and return raw broker's information about instrument by its ticker. Variable ticker must be defined!

Parameters

- requestPrice: if

Falsethen do not request current price of instrument (because this is long operation). - show: if

Falsethen do not runShowInstrumentInfo()method and do not print info to the console.

Returns

JSON formatted data with information about instrument.

Search and return raw broker's information about instrument by its FIGI. Variable figi must be defined!

Parameters

- requestPrice: if

Falsethen do not request current price of instrument (it's long operation). - show: if

Falsethen do not runShowInstrumentInfo()method and do not print info to the console.

Returns

JSON formatted data with information about instrument.

Get and show Depth of Market with current prices of the instrument as dictionary. Result example with depth 5:

{"buy": [{"price": 1243.8, "quantity": 193},

{"price": 1244.0, "quantity": 168},

{"price": 1244.8, "quantity": 5},

{"price": 1245.0, "quantity": 61},

{"price": 1245.4, "quantity": 60}],

"sell": [{"price": 1243.6, "quantity": 8},

{"price": 1242.6, "quantity": 10},

{"price": 1242.4, "quantity": 18},

{"price": 1242.2, "quantity": 50},

{"price": 1242.0, "quantity": 113}],

"limitUp": 1619.0, "limitDown": 903.4, "lastPrice": 1243.8, "closePrice": 1263.0}, where parameters mean:

- buy: list of dicts with Sellers prices, see also: https://tinkoff.github.io/investAPI/marketdata/#order

- sell: list of dicts with Buyers prices,

- price: price of 1 instrument (to get the cost of the lot, you need to multiply it by the lot of size of the instrument),

- quantity: volume value by current price in lots,

- limitUp: current trade session limit price, maximum,

- limitDown: current trade session limit price, minimum,

- lastPrice: last deal price of the instrument,

- closePrice: previous trade session close price of the instrument.

See also: SearchByTicker() and SearchByFIGI().

REST API for request: https://tinkoff.github.io/investAPI/swagger-ui/#/MarketDataService/MarketDataService_GetOrderBook

Response fields: https://tinkoff.github.io/investAPI/marketdata/#getorderbookresponse

Parameters

- show: if

Truethen print DOM to log and console.

Returns

orders book dict with lists of current buy and sell prices:

{"buy": [{"price": x1, "quantity": y1, ...}], "sell": [....]}. If an error occurred then returns an empty record:{"buy": [], "sell": [], "limitUp": None, "limitDown": None, "lastPrice": None, "closePrice": None}.

This method get and show information about all available broker instruments for current user account.

If instrumentsFile string is not empty then also save information to this file.

Parameters

- show: if

Truethen print results to console, ifFalse— print only to file. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

multi-lines string with all available broker instruments.

This method search and show information about instruments by part of its ticker, FIGI or name.

If searchResultsFile string is not empty then also save information to this file.

Parameters

- pattern: string with part of ticker, FIGI or instrument's name.

- show: if

Truethen print results to console, ifFalse— return list of result only. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

list of dictionaries with all found instruments.

Creating list with unique instrument FIGIs from input list of tickers (priority) or FIGIs.

Parameters

- instruments: list of strings with tickers or FIGIs.

Returns

list with unique instrument FIGIs only.

This method get, maybe show and return prices of list of instruments. WARNING! This is potential long operation!

See limits: https://tinkoff.github.io/investAPI/limits/

If pricesFile string is not empty then also save information to this file.

Parameters

- instruments: list of strings with tickers or FIGIs.

- show: if

Truethen prints prices to console, ifFalse— prints only to filepricesFile. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

list of instruments looks like

[{some ticker info, "currentPrice": {current prices}}, {...}, ...]. One item is dict returned bySearchByTicker()orSearchByFIGI()methods.

Show table contains current prices of given instruments.

Parameters

- **iList: list of instruments looks like

[{some ticker info, "currentPrice"**: {current prices}}, {...}, ...]. One item is dict returned bySearchByTicker(requestPrice=True)or bySearchByFIGI(requestPrice=True)methods. - show: if

Truethen prints prices to console, ifFalse— prints only to filepricesFile. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

multilines text in Markdown format as a table contains current prices.

Requesting trading status for the instrument defined by figi variable.

Documentation: https://tinkoff.github.io/investAPI/marketdata/#gettradingstatusrequest

Returns

dictionary with trading status attributes. Response example:

{"figi": "TCS00A103X66", "tradingStatus": "SECURITY_TRADING_STATUS_NOT_AVAILABLE_FOR_TRADING", "limitOrderAvailableFlag": false, "marketOrderAvailableFlag": false, "apiTradeAvailableFlag": true}

Requesting actual user's portfolio for current accountId.

REST API for user portfolio: https://tinkoff.github.io/investAPI/swagger-ui/#/OperationsService/OperationsService_GetPortfolio

Documentation: https://tinkoff.github.io/investAPI/operations/#portfoliorequest

Returns

dictionary with user's portfolio.

Requesting open positions by currencies and instruments for current accountId.

REST API for open positions: https://tinkoff.github.io/investAPI/swagger-ui/#/OperationsService/OperationsService_GetPositions

Documentation: https://tinkoff.github.io/investAPI/operations/#positionsrequest

Returns

dictionary with open positions by instruments.

Requesting current actual pending limit orders for current accountId.

REST API for pending (market) orders: https://tinkoff.github.io/investAPI/swagger-ui/#/OrdersService/OrdersService_GetOrders

Documentation: https://tinkoff.github.io/investAPI/orders/#getordersrequest

Returns

list of dictionaries with pending limit orders.

Requesting current actual stop orders for current accountId.

REST API for opened stop-orders: https://tinkoff.github.io/investAPI/swagger-ui/#/StopOrdersService/StopOrdersService_GetStopOrders

Documentation: https://tinkoff.github.io/investAPI/stoporders/#getstopordersrequest

Returns

list of dictionaries with stop orders.

Get portfolio: all open positions, orders, some statistics for current accountId.

If overviewFile, overviewDigestFile, overviewPositionsFile, overviewOrdersFile, overviewAnalyticsFile

and overviewBondsCalendarFile are defined, then also save information to file.

WARNING! It is not recommended to run this method too many times in a loop! The server receives many requests about the state of the portfolio, and then, based on the received data, a large number of calculations and statistics are collected.

Parameters

- show: if

Falsethen only dictionary returns ifTruethen shows more debug information. - details: how detailed should the information be?

full— shows full available information about portfolio status (by default),positions— shows only open positions,orders— shows only sections of open limits and stop orders.digest— shows a short digest of the portfolio status,analytics— shows only the analytics section and the distribution of the portfolio by various categories,calendar— shows only the bonds calendar section (if these are present in portfolio).

- onlyFiles: if

True, then does not show the Markdown table in the console but only generates report files.

Returns

dictionary with a client's raw portfolio and some statistics.

Returns history operations between two given dates for current accountId.

If reportFile string is not empty then also save human-readable report.

Shows some statistical data of closed positions.

Parameters

- start: see docstring in

TradeRoutines.GetDatesAsString()method. - end: see docstring in

TradeRoutines.GetDatesAsString()method. - show: if

Truethen also prints all records to the console. - showCancelled: if

Falsethen remove information about cancelled operations from the deals report. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

original list of dictionaries with history of deals records from API ("operations" key): https://tinkoff.github.io/investAPI/swagger-ui/#/OperationsService/OperationsService_GetOperations and dictionary with custom stats: operations in different currencies, withdrawals, incomes etc.

This method returns last history candles of the current instrument defined by ticker or figi (FIGI id).

History returned between two given dates: start and end. Minimum requested date in the past is 1970-01-01.

Warning! Broker server used ISO UTC time by default.

If historyFile is not None then method save history to file, otherwise return only Pandas DataFrame.

Also, historyFile used to update history with onlyMissing parameter.

See also: LoadHistory() and ShowHistoryChart() methods.

Parameters

- start: see docstring in

TradeRoutines.GetDatesAsString()method. - end: see docstring in

TradeRoutines.GetDatesAsString()method. - interval: this is a candle interval. Current available values are

"1min","5min","15min","hour","day". Default:"hour". - onlyMissing: if

Truethen add only last missing candles, do not request all history length fromstart. False by default. Warning! History appends only from last candle to current time with always update last candle! - csvSep: separator if csv-file is used,

,by default. - show: if

Truethen also prints Pandas DataFrame to the console.

Returns

Pandas DataFrame with prices history. Headers of columns are defined by default:

["date", "time", "open", "high", "low", "close", "volume"].

Load candles history from csv-file and return Pandas DataFrame object.

See also: History() and ShowHistoryChart() methods.

Parameters

- filePath: path to csv-file to open.

- show: if

Truethen also prints Pandas DataFrame to the console.

Returns

Pandas DataFrame with prices history. Headers of columns are defined by default:

["date", "time", "open", "high", "low", "close", "volume"].

Render an HTML-file with interact or non-interact candlesticks chart. Candles may be path to the csv-file.

Self variable htmlHistoryFile can be use as html-file name to save interaction or non-interaction chart.

Default: index.html (both for interact and non-interact candlesticks chart).

See also: History() and LoadHistory() methods.

Parameters

- candles: string to csv-file with candles in OHLCV-model or like Pandas Dataframe object.

- interact: if True (default) then chain of candlesticks will render as interactive Bokeh chart. See examples: https://github.com/Tim55667757/PriceGenerator#overriding-parameters If False then chain of candlesticks will render as not interactive Google Candlestick chart. See examples: https://github.com/Tim55667757/PriceGenerator#statistics-and-chart-on-a-simple-template

- openInBrowser: if True then immediately open chart in default browser, otherwise only path to

html-file prints to console. False by default, to avoid issues with

permissions deniedto html-file.

Universal method to create market order and make deal at the current price for current accountId. Returns JSON data with response.

If tp or sl > 0, then in additional will open stop-orders with "TP" and "SL" flags for stopType parameter.

See also: Order() docstring. More simple methods than Trade() are Buy() and Sell().

Parameters

- operation: string "Buy" or "Sell".

- lots: volume, integer count of lots >= 1.

- tp: float > 0, target price for stop-order with "TP" type. It used as take profit parameter

targetPriceinself.Order(). - sl: float > 0, target price for stop-order with "SL" type. It used as stop loss parameter

targetPriceinself.Order(). - expDate: string "Undefined" by default or local date in the future,

it is a string with format

%Y-%m-%d %H:%M:%S.

Returns

JSON with response from broker server.

More simple method than Trade(). Create Buy market order and make deal at the current price. Returns JSON data with response.

If tp or sl > 0, then in additional will open stop-orders with "TP" and "SL" flags for stopType parameter.

See also: Order() and Trade() docstrings.

Parameters

- lots: volume, integer count of lots >= 1.

- tp: float > 0, take profit price of stop-order.

- sl: float > 0, stop loss price of stop-order.

- expDate: it's a local date in the future.

String has a format like this:

%Y-%m-%d %H:%M:%S.

Returns

JSON with response from broker server.

More simple method than Trade(). Create Sell market order and make deal at the current price. Returns JSON data with response.

If tp or sl > 0, then in additional will open stop-orders with "TP" and "SL" flags for stopType parameter.

See also: Order() and Trade() docstrings.

Parameters

- lots: volume, integer count of lots >= 1.

- tp: float > 0, take profit price of stop-order.

- sl: float > 0, stop loss price of stop-order.

- expDate: it's a local date in the future.

String has a format like this:

%Y-%m-%d %H:%M:%S.

Returns

JSON with response from broker server.

Close position of given instruments.

Parameters

- instruments: list of instruments defined by tickers or FIGIs that must be closed.

- portfolio: pre-received dictionary with open trades, returned by

Overview()method. This avoids unnecessary downloading data from the server.

Close all positions of given instruments with defined type.

Parameters

- iType: type of the instruments that be closed, it must be one of supported types in

TKS_INSTRUMENTSlist. - portfolio: pre-received dictionary with open trades, returned by

Overview()method. This avoids unnecessary downloading data from the server.

Universal method to create market or limit orders with all available parameters for current accountId.

See more simple methods: BuyLimit(), BuyStop(), SellLimit(), SellStop().

If orderType is "Limit" then create pending limit-order below current price if operation is "Buy" and above current price if operation is "Sell". A limit order has no expiration date, it lasts until the end of the trading day.

Warning! If you try to create limit-order above current price if "Buy" or below current price if "Sell" then broker immediately open market order as you can do simple --buy or --sell operations!

If orderType is "Stop" then creates stop-order with any direction "Buy" or "Sell". When current price will go up or down to target price value then broker opens a limit order. Stop-order is opened with unlimited expiration date by default, or you can define expiration date with expDate parameter.

Only one attempt without retries recommended for opens order, set self.retry = 0. If network issue occurred you can create new request.

Parameters

- operation: string "Buy" or "Sell".

- orderType: string "Limit" or "Stop".

- lots: volume, integer count of lots >= 1.

- targetPrice: target price > 0. This is open trade price for limit order.

- limitPrice: limit price >= 0. This parameter only makes sense for stop-order. If limitPrice = 0, then it set as targetPrice. Broker will create limit-order with price equal to limitPrice, when current price goes to target price of stop-order.

- stopType: string "Limit" by default. This parameter only makes sense for stop-order. There are 3 stop-order types "SL", "TP", "Limit" for "Stop loss", "Take profit" and "Stop limit" types accordingly. Stop loss order always executed by market price.

- expDate: string "Undefined" by default or local date in the future.

String has a format like this:

%Y-%m-%d %H:%M:%S. This date is converting to UTC format for server. This parameter only makes sense for stop-order. A limit order has no expiration date, it lasts until the end of the trading day.

Returns

JSON with response from broker server.

Create pending Buy limit-order (below current price). You must specify only 2 parameters:

lots and target price to open buy limit-order. If you try to create buy limit-order above current price then

broker immediately open Buy market order, such as if you do simple --buy operation!

See also: Order() docstring.

Parameters

- lots: volume, integer count of lots >= 1.

- targetPrice: target price > 0. This is open trade price for limit order.

Returns

JSON with response from broker server.

Create Buy stop-order. You must specify at least 2 parameters: lots target price to open buy stop-order.

In additional you can specify 3 parameters for buy stop-order: limit price >=0, stop type = Limit|SL|TP,

expiration date = Undefined|%%Y-%%m-%%d %%H:%%M:%%S. When current price will go up or down to

target price value then broker opens a limit order. See also: Order() docstring.

Parameters

- lots: volume, integer count of lots >= 1.

- targetPrice: target price > 0. This is trigger price for buy stop-order.

- limitPrice: limit price >= 0 (limitPrice = targetPrice if limitPrice is 0). Broker will create limit-order with price equal to limitPrice, when current price goes to target price of buy stop-order.

- stopType: string "Limit" by default. There are 3 stop-order types "SL", "TP", "Limit" for "Stop loss", "Take profit" and "Stop limit" types accordingly.

- expDate: string "Undefined" by default or local date in the future.

String has a format like this:

%Y-%m-%d %H:%M:%S. This date is converting to UTC format for server.

Returns

JSON with response from broker server.

Create pending Sell limit-order (above current price). You must specify only 2 parameters:

lots and target price to open sell limit-order. If you try to create sell limit-order below current price then

broker immediately open Sell market order, such as if you do simple --sell operation!

See also: Order() docstring.

Parameters

- lots: volume, integer count of lots >= 1.

- targetPrice: target price > 0. This is open trade price for limit order.

Returns

JSON with response from broker server.

Create Sell stop-order. You must specify at least 2 parameters: lots target price to open sell stop-order.

In addition, you can specify 3 parameters in sell stop-order: limit price >=0, stop type = Limit|SL|TP,

expiration date = Undefined|%%Y-%%m-%%d %%H:%%M:%%S. When current price will go up or down to

target price value then broker opens a limit order. See also: Order() docstring.

Parameters

- lots: volume, integer count of lots >= 1.

- targetPrice: target price > 0. This is trigger price in sell stop-order.

- limitPrice: limit price >= 0 (limitPrice = targetPrice if limitPrice is 0). Broker will create limit-order with price equal to limitPrice, when current price goes to target price of sell stop-order.

- stopType: string "Limit" by default. There are 3 stop-order types "SL", "TP", "Limit" for "Stop loss", "Take profit" and "Stop limit" types accordingly.

- expDate: string "Undefined" by default or local date in the future.

String has a format like this:

%Y-%m-%d %H:%M:%S. This date is converting to UTC format for server.

Returns

JSON with response from broker server.

Cancel order or list of orders by its orderId or stopOrderId for current accountId.

Parameters

- orderIDs: list of integers with

orderIdorstopOrderId. - allOrdersIDs: pre-received lists of all active pending limit orders. This avoids unnecessary downloading data from the server.

- allStopOrdersIDs: pre-received lists of all active stop orders.

Close all available (not blocked) opened trades and orders.

Also, you can select one or more keywords case-insensitive:

orders, shares, bonds, etfs and futures from TKS_INSTRUMENTS enum to specify trades type.

Currency positions you must close manually using buy or sell operations, CloseTrades() or CloseAllTrades() methods.

Close all available (not blocked) opened trades and orders for one instrument defined by its ticker.

This method searches opened trade and orders of instrument throw all portfolio and then use

CloseTrades() and CloseOrders() methods to close trade and cancel all orders for that instrument.

See also: IsInLimitOrders(), GetLimitOrderIDs(), IsInStopOrders(), GetStopOrderIDs(), CloseTrades() and CloseOrders().

Parameters

- instrument: string with ticker.

Close all available (not blocked) opened trades and orders for one instrument defined by its FIGI id.

This method searches opened trade and orders of instrument throw all portfolio and then use

CloseTrades() and CloseOrders() methods to close trade and cancel all orders for that instrument.

See also: IsInLimitOrders(), GetLimitOrderIDs(), IsInStopOrders(), GetStopOrderIDs(), CloseTrades() and CloseOrders().

Parameters

- instrument: string with FIGI id.

Parse input dictionary of strings with order parameters and return dictionary with parameters to open all orders.

Parameters

- operation: string "Buy" or "Sell".

- inputParameters: this is dict of strings that looks like this

{"lots": "L_int,...", "prices": "P_float,..."}where "lots" key: one or more lot values (integer numbers) to open with every limit-order "prices" key: one or more prices to open limit-orders Counts of values in lots and prices lists must be equals!

Returns

list of dictionaries with all lots and prices to open orders that looks like this

[{"lot": lots_1, "price": price_1}, {...}, ...]

Checks if instrument is in the user's portfolio. Instrument must be defined by ticker (highly priority) or figi.

Parameters

- portfolio: dict with user's portfolio data. If

None, then requests portfolio fromOverview()method.

Returns

Trueif portfolio contains open position with given instrument,Falseotherwise.

Returns instrument from the user's portfolio if it presents there.

Instrument must be defined by ticker (highly priority) or figi.

Parameters

- portfolio: dict with user's portfolio data. If

None, then requests portfolio fromOverview()method.

Returns

dict with instrument if portfolio contains open position with this instrument,

Noneotherwise.

Checks if instrument is in the limit orders list. Instrument must be defined by ticker (highly priority) or figi.

See also: CloseAllByTicker() and CloseAllByFIGI().

Parameters

- portfolio: dict with user's portfolio data. If

None, then requests portfolio fromOverview()method.

Returns

Trueif limit orders list contains some limit orders for the instrument,Falseotherwise.

Returns list with all orderIDs of opened pending limit orders for the instrument.

Instrument must be defined by ticker (highly priority) or figi.

See also: CloseAllByTicker() and CloseAllByFIGI().

Parameters

- portfolio: dict with user's portfolio data. If

None, then requests portfolio fromOverview()method.

Returns

list with

orderIDs of limit orders.

Checks if instrument is in the stop orders list. Instrument must be defined by ticker (highly priority) or figi.

See also: CloseAllByTicker() and CloseAllByFIGI().

Parameters

- portfolio: dict with user's portfolio data. If

None, then requests portfolio fromOverview()method.

Returns

Trueif stop orders list contains some stop orders for the instrument,Falseotherwise.

Returns list with all orderIDs of opened stop orders for the instrument.

Instrument must be defined by ticker (highly priority) or figi.

See also: CloseAllByTicker() and CloseAllByFIGI().

Parameters

- portfolio: dict with user's portfolio data. If

None, then requests portfolio fromOverview()method.

Returns

list with

orderIDs of stop orders.

Method for obtaining the available funds for withdrawal for current accountId.

See also:

- REST API for limits: https://tinkoff.github.io/investAPI/swagger-ui/#/OperationsService/OperationsService_GetWithdrawLimits

OverviewLimits()method

Returns

dict with raw data from server that contains free funds for withdrawal. Example of dict:

{"money": [{"currency": "rub", "units": "100", "nano": 290000000}, {...}], "blocked": [...], "blockedGuarantee": [...]}. Heremoneyis an array of portfolio currency positions,blockedis an array of blocked currency positions of the portfolio andblockedGuaranteeis locked money under collateral for futures.

Method for parsing and show table with available funds for withdrawal for current accountId.

See also: RequestLimits().

Parameters

- show: if

Falsethen only dictionary returns, ifTruethen also print withdrawal limits to log. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

dict with raw parsed data from server and some calculated statistics about it.

Method for requesting all brokerage accounts (accountIds) of current user detected by token.

See also:

- REST API: https://tinkoff.github.io/investAPI/swagger-ui/#/UsersService/UsersService_GetAccounts

- What does account fields mean: https://tinkoff.github.io/investAPI/users/#account

OverviewUserInfo()method

Returns

dict with raw data from server that contains accounts info. Example of dict:

{"accounts": [{"id": "20000xxxxx", "type": "ACCOUNT_TYPE_TINKOFF", "name": "TKSBrokerAPI account", "status": "ACCOUNT_STATUS_OPEN", "openedDate": "2018-05-23T00:00:00Z", "closedDate": "1970-01-01T00:00:00Z", "accessLevel": "ACCOUNT_ACCESS_LEVEL_FULL_ACCESS"}, ...]}. IfclosedDate="1970-01-01T00:00:00Z"it means that account is active now.

Method for requesting common user information.

See also:

- REST API: https://tinkoff.github.io/investAPI/swagger-ui/#/UsersService/UsersService_GetInfo

- What does user info fields mean: https://tinkoff.github.io/investAPI/users/#getinforequest

- What does

qualified_for_work_withfield mean: https://tinkoff.github.io/investAPI/faq_users/#qualified_for_work_with OverviewUserInfo()method

Returns

dict with raw data from server that contains user's information. Example of dict:

{"premStatus": true, "qualStatus": false, "qualifiedForWorkWith": ["bond", "foreign_shares", "leverage", "russian_shares", "structured_income_bonds"], "tariff": "premium"}.

Method for requesting margin calculation for defined account ID.

See also:

- REST API: https://tinkoff.github.io/investAPI/swagger-ui/#/UsersService/UsersService_GetMarginAttributes

- What does margin fields mean: https://tinkoff.github.io/investAPI/users/#getmarginattributesresponse

OverviewUserInfo()method

Parameters

- accountId: string with numeric account ID. If

None, then used class fieldaccountId.

Returns

dict with raw data from server that contains margin calculation. If margin is disabled then returns empty dict. Example of responses: status code 400:

{"code": 3, "message": "account margin status is disabled", "description": "30051" }, returns:{}. status code 200:{"liquidPortfolio": {"currency": "rub", "units": "7175", "nano": 560000000}, "startingMargin": {"currency": "rub", "units": "6311", "nano": 840000000}, "minimalMargin": {"currency": "rub", "units": "3155", "nano": 920000000}, "fundsSufficiencyLevel": {"units": "1", "nano": 280000000}, "amountOfMissingFunds": {"currency": "rub", "units": "-863", "nano": -720000000}}.

Method for requesting limits of current tariff (connections, API methods etc.) of current user detected by token.

See also:

- REST API: https://tinkoff.github.io/investAPI/swagger-ui/#/UsersService/UsersService_GetUserTariff

- What does fields in tariff mean: https://tinkoff.github.io/investAPI/users/#getusertariffrequest

- Unary limit: https://tinkoff.github.io/investAPI/users/#unarylimit

- Stream limit: https://tinkoff.github.io/investAPI/users/#streamlimit

OverviewUserInfo()method

Returns

dict with raw data from server that contains limits of current tariff. Example of dict:

{"unaryLimits": [{"limitPerMinute": 0, "methods": ["methods", "methods"]}, ...], "streamLimits": [{"streams": ["streams", "streams"], "limit": 6}, ...]}.

Requesting bond payment calendar from official placement date to maturity date. If these dates are unknown

then requesting dates "from": "1970-01-01T00:00:00.000Z" and "to": "2099-12-31T23:59:59.000Z".

All dates are in UTC timezone.

REST API: https://tinkoff.github.io/investAPI/swagger-ui/#/InstrumentsService/InstrumentsService_GetBondCoupons Documentation:

- request: https://tinkoff.github.io/investAPI/instruments/#getbondcouponsrequest

- response: https://tinkoff.github.io/investAPI/instruments/#coupon

See also: ExtendBondsData().

Parameters

- iJSON: raw json data of a bond from broker server, example

iJSON = self.iList["Bonds"][self._ticker]If raw iJSON is not data of bond then server returns an error [400] with message:{"code": 3, "message": "instrument type is not bond", "description": "30048"}.

Returns

dictionary with bond payment calendar. Response example

{"events": [{"figi": "TCS00A101YV8", "couponDate": "2023-07-26T00:00:00Z", "couponNumber": "12", "fixDate": "2023-07-25T00:00:00Z", "payOneBond": {"currency": "rub", "units": "7", "nano": 170000000}, "couponType": "COUPON_TYPE_CONSTANT", "couponStartDate": "2023-04-26T00:00:00Z", "couponEndDate": "2023-07-26T00:00:00Z", "couponPeriod": 91}, {...}, ...]}

Requests jsons with raw bonds data for every ticker or FIGI in instruments list and transform it to the wider Pandas DataFrame with more information about bonds: main info, current prices, bond payment calendar, coupon yields, current yields and some statistics etc.

WARNING! This is too long operation if a lot of bonds requested from broker server.

See also: ShowInstrumentInfo(), CreateBondsCalendar(), ShowBondsCalendar(), RequestBondCoupons().

Parameters

- instruments: list of strings with tickers or FIGIs.

- xlsx: if True then also exports Pandas DataFrame to xlsx-file

bondsXLSXFile, defaultext-bonds.xlsx, for further used by data scientists or stock analytics.

Returns

wider Pandas DataFrame with more full and calculated data about bonds, than raw response from broker. In XLSX-file and Pandas DataFrame fields mean: - main info about bond: https://tinkoff.github.io/investAPI/instruments/#bond - info about coupon: https://tinkoff.github.io/investAPI/instruments/#coupon

Creates bond payments calendar as Pandas DataFrame, and also save it to the XLSX-file, calendar.xlsx by default.

WARNING! This is too long operation if a lot of bonds requested from broker server.

See also: ShowBondsCalendar(), ExtendBondsData().

Parameters

- extBonds: Pandas DataFrame object returns by

ExtendBondsData()method and contains extended information about bonds: main info, current prices, bond payment calendar, coupon yields, current yields and some statistics etc. If this parameter isNonethen usedfigiortickeras bond name and then calculateExtendBondsData(). - xlsx: if True then also exports Pandas DataFrame to file

calendarFile+".xlsx",calendar.xlsxby default, for further used by data scientists or stock analytics.

Returns

Pandas DataFrame with only bond payments calendar data. Fields mean: https://tinkoff.github.io/investAPI/instruments/#coupon

Show bond payments calendar as a table. One row in input bonds dataframe contains one bond.

Also, creates Markdown file with calendar data, calendar.md by default.

See also: ShowInstrumentInfo(), RequestBondCoupons(), CreateBondsCalendar() and ExtendBondsData().

Parameters

- extBonds: Pandas DataFrame object returns by

ExtendBondsData()method and contains extended information about bonds: main info, current prices, bond payment calendar, coupon yields, current yields and some statistics etc. If this parameter isNonethen usedfigiortickeras bond name and then calculateExtendBondsData(). - show: if

Truethen also printing bonds payment calendar to the console, otherwise save to filecalendarFileonly.Falseby default. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

multilines text in Markdown format with bonds payment calendar as a table.

Method for parsing and show simple table with all available user accounts.

See also: RequestAccounts() and OverviewUserInfo() methods.

Parameters

- show: if

Falsethen only dictionary with accounts data returns, ifTruethen also print it to log. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

dict with parsed accounts data received from

RequestAccounts()method. Example of dict:view = {"rawAccounts": {rawAccounts from RequestAccounts() method...}, "stat": {"accountId string": {"type": "Tinkoff brokerage account", "name": "Test - 1", "status": "Opened and active account", "opened": "2018-05-23 00:00:00", "closed": "—", "access": "Full access" }, ...}}

Method for parsing and show all available user's data (accountIds, common user information, margin status and tariff connections limit).

See also: OverviewAccounts(), RequestAccounts(), RequestUserInfo(), RequestMarginStatus() and RequestTariffLimits() methods.

Parameters

- show: if

Falsethen only dictionary returns, ifTruethen also print user's data to log. - onlyFiles: if

Truethen do not show Markdown table in the console, but only generates report files.

Returns

dict with raw parsed data from server and some calculated statistics about it.

Periodically updates history for a list of tickers using cron expression and multithreading. This method blocks execution in an infinite loop. Can be used for --auto-update mode.

Required fields for history update must be passed via **kwargs and will be forwarded to self.History().

Example: HistoryAutoUpdater( tickersList=["GAZP", "SBER"], crontabExpr="*/2 10-18,19-23 * * 0-6", timeToSleep=300, interval="hour", onlyMissing=True, show=True, csvSep="," )

Parameters

- tickersList: List of ticker symbols to update.

- dateStart: This is

startparameter fromTinkoffBrokerServer.History()method. Default is-3. See alsoTradeRoutines.GetDatesAsString()method. - outputDir: Output directory where history files are stored. Default is

Nonemean current workdir. - crontabExpr: Cron-style schedule string (evaluated by pycron). Default is

*/5 10-23 * * 1-5. See example at https://crontab.guru/#/5_10-23__*_1-5 - waitAfterIteration: Delay in seconds after each iteration completed, default is

60seconds. - waitNext: Technical pause (in seconds) between two crontab checks, default is

1second. - kwargs: All additional keyword arguments are passed to the

History()method of theTinkoffBrokerServer()class, include token and accountId.

If the Main () function is imported as module, then this class used to convert arguments from **kwargs as object.

This function gets and parses command line keys.

Main function for work with TKSBrokerAPI Platform in the console.

See examples: